If you are a real estate landlord, you know that there are many things to keep track of. Between managing your properties, dealing with tenants, and keeping track of your finances, it can be a lot to handle on your own. That is why many landlords choose to work with accountants. They can help you manage your finances and make sure that you make the most money from your properties. This blog post will discuss the top reasons why real estate landlords need accountants.

They Help Keeping Rental Accounts

As a landlord, you are responsible for collecting rent from your tenants and paying any associated bills (such as property taxes or insurance). An accountant can help you keep track of all of your rental income and expenses to know exactly how much money you are making (or losing) each month. This information is valuable in helping you make decisions about your properties, such as whether to raise rents or make repairs. Additionally, an accountant can help you prepare for tax time. They can ensure that you are taking all of the deductions that you are entitled to, and they can help you file your taxes in a timely and accurate manner. This can save you a lot of stress come.

They Plan for Capital Gains Tax

If you are ever thinking of selling your rental property, an accountant can help you plan for capital gains tax. Capital gains tax is a tax on the profit you make from selling an asset. When it comes to real estate, the amount of capital gains tax you will owe depends on how long you have owned the property. If you have owned the property for less than one year, you will owe short-term capital gains tax (CGT). If you have owned the property for more than a year, you will owe long-term CGT.

They Help Claim Self-Assessment Expenses

Another reason to work with an accountant is that they can help you claim self-assessment expenses. If you are renting out multiple properties, you may be able to deduct a portion of your accounting fees from your taxes. This can save you a lot of money come tax time. Additionally, an accountant can help you set up a system for tracking your expenses. If you’re a landlord with rental properties, it’s crucial to have an accountant on your team. They can help ensure that everything is in order and that you’re taking all of the deductions you deserve. Consider why accountants are so important for landlords – and contact us if you need help finding the right one for your business.…

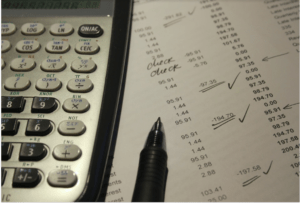

When carrying out personal bookkeeping, it is just as easy to get confused with the complications of adding up the figures. Always try to focus on simplicity. Not all businesses are similar, so if you can personalize your books to fit your business operational model, the better. If you are not confident in your ability to track income and expenses as well as the tax laws required to make your submissions do not shy away from seeking professional assistance.…

When carrying out personal bookkeeping, it is just as easy to get confused with the complications of adding up the figures. Always try to focus on simplicity. Not all businesses are similar, so if you can personalize your books to fit your business operational model, the better. If you are not confident in your ability to track income and expenses as well as the tax laws required to make your submissions do not shy away from seeking professional assistance.…